Electronic Arts in 2025: How EA Shaped Modern Gaming Through Live Service Models

In less than a decade, Electronic Arts has fundamentally transformed how games are developed, monetized, and experienced by players worldwide. From a traditional publisher focused on annual releases and one-time purchases, EA has evolved into a service-oriented entertainment provider, creating persistent gaming ecosystems that generate consistent revenue and engagement. This shift represents one of the most significant business model transformations in modern entertainment history, influencing the entire gaming industry while reshaping player expectations. This article examines how EA’s pivot to live service models has redefined modern gaming.

The Evolution of EA’s Business Model

From Boxed Games to Digital Downloads

The journey toward live service models began with EA’s transition from physical to digital distribution. While other publishers approached digital distribution as simply a new delivery method, EA recognized it as an opportunity to fundamentally rethink how games could be monetized and updated.

The Origin Platform Launch and Its Impact

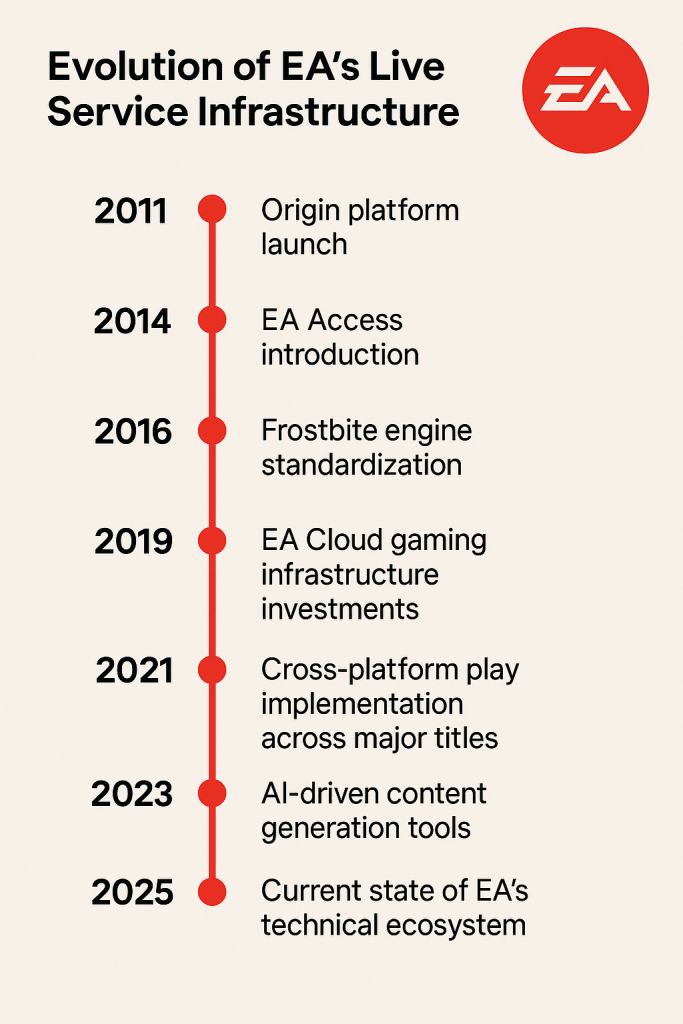

EA’s launch of Origin in 2011 marked its first significant step toward controlling its digital distribution ecosystem. Despite initial player resistance to yet another launcher, Origin provided EA with crucial infrastructure for what would come next: direct relationships with players, eliminating middlemen, and real-time data on player behavior.

Key Milestones in EA’s Digital Transition

Between 2015 and 2020, EA’s digital revenue grew from approximately 52% to over 78% of total revenue. By 2025, that figure has reached 94%, with physical sales representing primarily collector’s editions and legacy markets. This transition wasn’t merely a shift in distribution but fundamentally altered EA’s approach to game design and monetization strategies.

Introduction of Subscription Services

EA’s subscription services represented its next evolutionary step, transitioning from one-time purchases to recurring revenue models.

EA Access/EA Play Development History

Launched initially on Xbox One in 2014, EA Access (later rebranded as EA Play) offered subscribers access to a growing library of games for a monthly fee. Initially met with skepticism, the subscription model proved extraordinarily successful, providing stable revenue and, more importantly, keeping players within EA’s ecosystem.

Subscription Metrics and Growth (2020-2025)

EA Play subscribers grew from approximately 6.5 million in 2020 to over 35 million by 2025, representing one of EA’s most significant growth vectors. This subscription base provides a steady revenue stream and serves as a marketing channel for new games and in-game purchases.

The Pivot to Games-as-a-Service

EA’s most transformative move was reimagining games not as products but as ongoing services that evolve over time.

Financial Transformation and Revenue Streams

The service model created multiple revenue streams from the same intellectual property: base game sales, subscription access, season passes, and microtransactions. By 2025, a successful EA game generates up to 70% of its lifetime revenue after the initial launch, compared to just 20% in the traditional model.

Investor Response to the Business Model Shift

Wall Street initially questioned EA’s transition, with stock volatility during the early implementation years. However, as predictable revenue patterns emerged and player engagement metrics improved, EA’s market capitalization grew substantially, outperforming the S&P 500 by over 60% between 2020 and 2025.

EA’s Flagship Live Service Games

EA’s implementation of live services varies significantly across franchises, with each adapting the model to fit its unique audience and gameplay style.

EA Sports Titles and Ultimate Team

Electronic Arts’ sports franchises pioneered the live service model even before the term became industry standard.

FIFA/EA Sports FC Evolution

The transition from FIFA to EA Sports FC in 2023 allowed EA greater flexibility in implementing service elements. By 2025, EA Sports FC features dynamic seasons that mirror real-world competitions, with content updates driven by actual sporting events and player performances. The game has effectively become a platform for virtual football rather than an annual product.

Madden NFL’s Seasonal Content Strategy

Madden NFL has evolved from annual roster updates to a continuous content model reflecting the NFL season’s rhythm. Weekly content drops coinciding with real NFL games keep engagement high throughout the season, while the offseason features draft content and special events.

Battlefield Series Transformation

The Battlefield franchise illustrates both the challenges and potential of transitioning established franchises to live service models.

Lessons Learned from Battlefield Launch Challenges

Battlefield 2042’s troubled launch in 2021 provided EA valuable lessons about live service implementation. Initial reception was negative due to missing features and stability issues, but by committing to post-launch development, EA gradually transformed the game into a success story.

Long-term Support and Community Building

By 2025, Battlefield has adopted a “community-first” approach, with transparent development roadmaps and player feedback directly influencing content priorities. This approach has rebuilt trust with the player base and created a sustainable engagement model.

Apex Legends as a Live Service Success Story

Apex Legends represents EA’s most successful implementation of the live service model from launch.

Battle Pass Innovation

Apex Legends refined the battle pass system pioneered by Fortnite, creating a progression model that rewards both casual and dedicated players while maintaining revenue growth. The game’s seasonal battle pass completion rate exceeds 70%, significantly above industry averages.

Seasonal Content and Character Releases

The regular cadence of new legends, weapons, map changes, and narrative events has maintained player interest since 2019, demonstrating how well-paced content drops can sustain engagement for years beyond what traditional sequel models could achieve.

The Sims’ Ongoing Expansion Strategy

The Sims franchise demonstrates how even primarily single-player experiences can adopt service elements successfully.

DLC and Expansion Pack Business Model

The Sims 4’s transition to a free base game with purchasable expansions created an accessible entry point with monetization focused on players seeking specific content. This approach has extended the game’s lifecycle far beyond industry norms.

Community Engagement and Modding Support

EA’s support for The Sims community, including user-generated content and modding tools, has created a self-sustaining ecosystem where players themselves generate reasons to remain engaged with the platform.

Technology Infrastructure Behind EA’s Live Services

EA’s service transformation required significant technology investments to support continuous operation and content delivery.

EA’s Cloud Gaming Investments

Electronic Arts has built robust cloud infrastructure to support its service ambitions, with significant investments in scalable server architecture.

Server Architecture and Scaling Solutions

EA’s proprietary server technology allows dynamic resource allocation during peak events like game launches or special in-game events. This infrastructure enables EA to support millions of concurrent players while maintaining performance standards.

Cross-Platform Play Implementation

By 2025, nearly all EA live service games support cross-platform play, eliminating traditional barriers between gaming ecosystems. This technical achievement required solving complex challenges around matchmaking, progression synchronization, and platform-specific requirements.

Data Analytics and Player Behavior

EA’s service model is built on a foundation of sophisticated data analytics that inform both business and design decisions.

Personalization Algorithms

EA games now feature dynamic content recommendations and gameplay adjustments based on individual player behavior. These systems use machine learning to identify patterns and preferences, customizing experiences to maximize engagement.

Engagement Optimization Techniques

EA has developed sophisticated techniques for keeping players in the “engagement zone” – balancing challenge and reward to maintain interest over extended periods. These systems adapt difficulty, matchmaking, and reward distribution based on real-time player data.

Development Pipeline Adjustments

Supporting live service games required fundamental changes to how EA develops software.

Transitioning from Waterfall to Continuous Delivery

EA’s studios have abandoned traditional development cycles in favor of continuous delivery models. This shift required rebuilding development pipelines, team structures, and QA methodologies to support rapid iteration without compromising quality.

Tools for Rapid Content Creation

Proprietary content creation tools allow EA’s studios to develop and deploy new content at unprecedented speeds. These systems include automated testing, streamlined approval processes, and modular design approaches that facilitate frequent updates.

Monetization Strategies in EA’s Ecosystem

EA has refined various monetization approaches across its live service portfolio, learning from both successes and controversies.

Microtransactions Evolution

Electronic Arts’ approach to microtransactions has evolved significantly following player feedback and regulatory scrutiny.

From Controversial Beginnings to Current Models

The Star Wars Battlefront II loot box controversy of 2017 marked a turning point in EA’s monetization strategy. By 2025, EA has shifted to transparent, value-oriented purchases that emphasize player choice and perceived fairness.

Regional Pricing and Market Adaptations

EA has implemented sophisticated regional pricing models that adjust monetization approaches based on local economic conditions, cultural preferences, and platform norms. This strategy has enabled significant growth in emerging markets, particularly in Southeast Asia and Latin America.

Battle Pass Systems Across Franchises

Battle passes have become standard across EA’s portfolio, though implementations vary based on game type and audience.

Reward Structures and Psychology

EA has refined battle pass design to balance immediate gratification with long-term goals, creating what behavioral economists call “reward schedules” that maintain player engagement throughout a season. These systems leverage both extrinsic and intrinsic motivators to drive regular play sessions.

Comparative Analysis with Competitor Approaches

While competitors often focus on cosmetic-only approaches, EA has experimented with gameplay benefits in battle passes, carefully balancing monetization potential against competitive integrity concerns.

Premium Currency Implementation

Virtual currencies serve as the backbone of EA’s in-game economies.

Economic Balance and Value Perception

EA maintains complex economic models for each game, adjusting currency values and earning rates to maintain perceived value while encouraging purchases. These models are continuously refined based on player behavior data.

Regulatory Challenges and Adaptations

As global regulations around virtual currencies and gambling mechanics have evolved, EA has proactively adapted its monetization approaches to ensure compliance while preserving revenue potential.

Major Live Service Games Performance Metrics

| Game Title | Launch Year | Monthly Active Users (2025) | Revenue Model | Content Update Frequency | Player Retention Rate |

|---|---|---|---|---|---|

| EA Sports FC | 2023 | 35M+ | Ultimate Team, Battle Pass | Weekly | 68% |

| Apex Legends | 2019 | 115M+ | Battle Pass, Cosmetics | Seasonal (Quarterly) | 72% |

| The Sims 4 | 2014 | 20M+ | Expansion Packs, Game Packs | Bi-monthly | 65% |

| Battlefield 2042 | 2021 | 18M+ | Premium Pass, Cosmetics | Monthly | 55% |

| EA SPORTS™ Madden NFL | Annual | 25M+ | Ultimate Team, Season Pass | Weekly | 61% |

Impact on the Gaming Industry

EA’s service transformation has influenced the broader gaming landscape in profound ways.

Influence on Competitor Business Models

Electronic Arts’ success with live services has triggered industry-wide changes in how games are designed and monetized.

Major Publishers Following EA’s Lead

By 2025, virtually every major publisher has adopted elements of EA’s approach, with varying degrees of success. Companies like Ubisoft, Take-Two, and Microsoft have all shifted toward service-oriented models for their major franchises.

Indie Adoption of Live Service Elements

Even independent developers have incorporated live service elements, often focusing on community engagement and post-launch support rather than aggressive monetization. This trend has blurred the traditional distinction between “indie” and “AAA” development approaches.

Player Expectation Shifts

Live services have fundamentally changed what players expect from their gaming experiences.

Content Cadence and Update Frequency

Regular content updates have become an expectation rather than a bonus. Games that launch without clear post-release content plans are often criticized, regardless of their initial quality or value proposition.

Value Perception of Gaming Purchases

Players increasingly evaluate games based on their long-term engagement potential rather than just the launch experience. This shift has created challenges for single-player, narrative-focused experiences that don’t naturally fit the service model.

Industry Employment Changes

The live service transition has transformed game development careers and team structures.

New Roles Created by Live Service Models

Specialized roles like “live operations manager,” “player experience designer,” and “economy balancer” have become standard at major studios. These positions focus on maintaining and optimizing existing games rather than creating new ones.

Development Team Structure Evolution

Studio structures have shifted from project-based teams that disband after launch to persistent teams that support games for years. This change has created more stable employment but also raised concerns about creative burnout and innovation.

Future Directions for EA’s Live Service Strategy

As EA continues to refine its approach, several emerging trends point to future developments in its service model.

Integration with Emerging Technologies

EA is actively exploring how new technologies can enhance its service offerings.

AR/VR Considerations

Despite mixed results with previous virtual reality initiatives, EA continues to experiment with immersive technologies, particularly for its sports franchises where physical embodiment could enhance the experience.

AI Implementation in Content Generation

Machine learning tools are increasingly used to generate game content, from environmental details to NPC behaviors. These technologies allow EA to create more dynamic worlds that respond to player activities with less manual development.

Sustainability Challenges

The service model faces long-term challenges that EA must address to maintain growth.

Content Creation Pace vs. Quality

Meeting player expectations for regular content while maintaining quality standards represents an ongoing challenge. EA has responded by developing more modular content creation pipelines and leveraging community creators where appropriate.

Player Retention in Maturing Services

As services mature, maintaining player interest becomes increasingly difficult. EA has begun experimenting with more dramatic seasonal transformations and narrative events to prevent engagement plateaus.

Market Expansion Opportunities

EA continues to seek new markets and audiences for its service offerings.

Untapped Geographic Markets

Emerging markets in Southeast Asia, India, and Africa represent significant growth potential. EA has developed market-specific strategies, including mobile-first approaches and alternative payment methods to address these opportunities.

Cross-Media Integration Possibilities

EA is exploring integration between its games and other media, including television, film, and music. These cross-media initiatives aim to create broader entertainment ecosystems around key intellectual properties.

Conclusion: EA’s Lasting Impact on Gaming

Electronic Arts’ transformation into a service-oriented company represents one of the most significant business model innovations in modern entertainment. By reimagining games as ongoing services rather than one-time products, EA has created sustained engagement and revenue growth while fundamentally changing how players interact with its properties.

Measuring Success Beyond Financial Metrics

While financial results validate EA’s approach, the company increasingly measures success through engagement metrics like play session frequency, player satisfaction scores, and community health indicators.

Community Health Indicators

EA has developed sophisticated tools for monitoring community sentiment and engagement, recognizing that healthy player communities are essential for long-term service success.

Innovation Legacy

Despite criticisms that the service model prioritizes monetization over innovation, EA has continued to introduce meaningful gameplay innovations across its portfolio, often through post-launch updates rather than new releases.

Lessons for the Broader Entertainment Industry

EA’s service transformation offers valuable lessons for entertainment companies beyond gaming as subscription models become increasingly dominant across media.

Subscription Economy Parallels

The success of EA Play parallels broader subscription trends in entertainment, with consumers increasingly preferring access over ownership across media types.

Content Creation and Consumption Patterns

EA’s experiences with engagement patterns and content cadence provide insights for other media companies transitioning to service models, particularly regarding the balance between quantity and quality in content production.

As Electronic Arts looks toward the future, its live service model continues to evolve, adapting to new technologies, player expectations, and market opportunities. What began as a business model experiment has become the foundation of modern gaming, with implications extending far beyond EA itself. The company that once defined gaming through annual releases and boxed products now defines it through persistent worlds, ongoing narratives, and community engagement – a transformation as profound as any in entertainment history.